There’s nothing more frustrating than having a client ghost me.

Whether it’s to follow up on project details, an upcoming deadline, a rescheduled kick-off meeting, late payment, or anything else, knowing how to send polite reminder emails is a soft skill you must develop as a service provider.

In this article, I’m going to go over seven common reasons why you might want to send a follow-up email for a certain request. I’ll talk about what to include in your reminder email, best practices, and go over actual templates you can customize to fit your specific needs.

Alright, let’s get into it.

What to include in a reminder email

When sending a reminder email, it’s important to look at things from your client’s perspective. Don’t get upset or angry if a certain ask has not been fulfilled yet. Rather, approach the situation with grace and professionalism.

An effective reminder email is short and to the point — bonus points if you can add a personalized flair. Here are some things you should include in a reminder email:

- A clear subject line: Your subject line is the first thing someone sees before they read your email. Make sure it grabs their attention. I’ll go over some examples of subject lines in the next section.

- A personalized greeting: This one is pretty obvious — you want to include your recipient's name to give the email a personal touch.

- The reminder purpose: Make sure to state the main reason for your email and why it’s important to them.

- Important details: Depending on the type of email, you want to clearly state dates, timelines, locations, or any immediate actions required.

- Call to action: Give clear directions on what you want the recipient to do when they read your email.

- Polite closing: End your email in a friendly way, with any additional information your recipient should know about.

- Professional sign-off: This part is pretty self-explanatory. Just make sure to sign off your email with your name and any contract information you think is important.

Alright, now let's look at some best practices and email subject line examples.

Best practices for reminder emails

Besides knowing what to put in your reminder email, you should also know how to communicate with proper email etiquette. Here are some best practices for sending reminder emails:

- Be timely: Send your reminder email at a strategic time, neither too early nor too late. This time will depend on your own knowledge of the recipient's time zone and workload. Aim to send your reminder email at a time you know your recipient will not be busy (but will be checking emails).

- Keep it short: Be concise yet comprehensive enough to convey all necessary details.

- Maintain professionalism: Even if you’re familiar with the recipient, it’s important to keep a professional tone. You can be playful and fun, just keep proper email etiquette.

- Be specific: Vague reminders can be confusing. Be clear about what you are reminding the recipient of. For example, if you’ve sent a previous email, make sure to be clear about what that email was about (don’t just assume they read it).

- Use bullet points: If the email includes multiple points, bullet them for easy reading.

- Personalize your message: Use your recipient’s name and tailor your emails to have a friendly tone and fit the relationship you have with the recipient.

- Proofread: Always double-check for errors and make sure the email is clear and well-written. Tools like Grammarly can help automate this.

Alright, now that we have some best practices in mind, let’s go over some email subject line examples you can use.

Reminder email subject lines

If someone doesn’t click on your subject line, they’ll never be able to read your email. While the contents of your email are important, having a strong subject line can make the difference between getting a quick response or getting lost in your recipient's inbox.

In the next section, I’m going to go over some reminder email examples and templates. These subject lines are based on those emails.

Reminder to schedule the next meeting:

- "Friendly Reminder: Let's Schedule Our Next Meeting"

- "Action Required: Schedule Our Upcoming Meeting"

- "Reminder: Time to Set Our Next Meeting Date"

Reminder about a late payment:

- "Gentle Reminder: Late Payment Notice"

- "Important: Outstanding Payment Reminder"

- "Urgent: Your Payment is Overdue"

Reminder to provide project feedback:

- "Reminder: Your Feedback on the Project is Needed"

- "Action Needed: Please Provide Your Project Feedback"

- "Friendly Reminder: Feedback Deadline Approaching"

Reminder about an upcoming project deadline:

- "Alert: Upcoming Project Deadline Reminder"

- "Important Reminder: Project Deadline is Near"

- "Heads Up: Your Project Deadline is Approaching"

Reminder to sign an updated contract:

- "Reminder: Updated Contract Awaits Your Signature"

- "Action Required: Please Sign the Updated Contract"

- "Notice: Signature Needed for Updated Contract"

Reminder to fill out a survey or intake form:

- "Reminder: Your Input is Needed – Please Fill Out the Survey"

- "Friendly Reminder: Intake Form Submission Required"

- "Action Needed: Please Complete Your Survey/Form"

Reminder of upcoming appointment:

- "Reminder: Your Upcoming Appointment Details"

- "Don’t Forget: Upcoming Appointment Reminder"

- "Upcoming Appointment Alert: Confirmation Needed"

Okay, now let’s get into our list of reminder emails.

7 gentle reminder email templates you can use

Here are seven reminder email examples for different types of needs:

- Reminder to schedule the next meeting

- Reminder about a late payment

- Reminder to provide project feedback

- Reminder about an upcoming project deadline

- Reminder to sign an updated contract

- Reminder to fill out a survey or intake form

- Reminder of an upcoming appointment

Alright, let’s take a look at each one.

1. Reminder to schedule the next meeting

Even with calendar invitations, it's common for progress meetings to fall through the cracks as projects ramp up. Sometimes we just get too focused on handling day-to-day tasks and lose sight of maintaining alignment with everyone on our team, or our clients. And sometimes, our own clients forget that they’re working with us!

That's when a friendly reminder comes in handy for politely recircling important standing meetings before they expire completely. Here’s an example of a meeting reminder email you can gain some inspiration from:

Hi [client name],

I'm checking in regarding scheduling our next quarterly progress meeting. Please let me know when you have availability in the next 2-3 weeks so we can ensure continued alignment on [project name].

I completely understand if you need to push things back in light of current priorities. Just send over a few windows of time that work best on your end whenever convenient, and I'll get something locked in.

Please don't hesitate to suggest your preferred dates/times. Thanks in advance!

Best regards,

[Your name]

Some key details this template includes:

- Personalized greeting with client's name

- Quick context on the purpose of meeting

- Emphasizes flexibility to reschedule if needed

- Open-ended request for recipient's availability

- Closing gratitude and signature

Overall, this simple email is a professional way to send a meeting reminder without coming off as too eager. Of course, depending on the type of service you’re providing, and at what frequency, you’ll want to edit the template to better fit your needs.

2. Reminder about a late payment

Sometimes invoice payments (hopefully) unintentionally fall through the cracks. Rather than getting frustrated with your client right away, or letting delays linger because you’re afraid of confrontation, a friendly reminder keeps things smoothly moving.

We already have a blog post on this topic, but here’s an effective yet professional late payment reminder email:

Hi [client name],

Gently following up on invoice #[number] from [date] for [amount] which is now past due. Please let me know if there is any issue with the billing details that need clarifying from my end or if you simply need more time to process!

Just wanted to provide a friendly reminder to take care of the outstanding payment at your earliest convenience. Please let me know if I can answer any questions!

Thanks in advance,

[Your name]

Key details this template includes:

- Personalized greeting with client name

- Quick specifics on the unpaid invoice

- Opens the door to clarify any potential confusion

- Polite request for processing the payment

- Closing signature with gratitude

The tone remains cordial and cooperative vs accusatory. Simply bringing the receivable back onto the client's radar propels resolution.

3. Reminder to provide project feedback

Sometimes you need your client’s feedback to continue moving forward with a certain project. And (most) clients love it when you communicate with them.

However, sometimes a client may be too busy and have a hard time staying on track with your working relationship. When reviews go silent, a gentle nudge can get your client to help you eliminate any bottlenecks.

Here's a polite template for requesting overdue feedback:

Hi [client name],

Checking if you've had a chance yet to provide any feedback on the [project name] strategy deck I sent over last week? No rush at all if it's still making its way up the priority list.

Just with our next planning session coming up on [date], I want to ensure I can incorporate your valuable thoughts into the next iteration. Please let me know if you need me to resend the file or have any difficulties accessing it.

Thanks so much in advance!

[Your name]

This reminder leads with:

- Personalized greeting and project specifics

- Reassurance on flexibility of deadlines

- Reason for requesting feedback by important date

- Offer of assistance accessing files

- Closing expression of gratitude

The tone remains collaborative and supportive, rather than demanding — helping you keep a reputation of being a kind and professional service provider.

4. Reminder about an upcoming project deadline

It’s no secret that keeping your client in the loop on what you’re doing can help boost client retention. Depending on the type of service you provide, you may need to work in steps.

For example, you may need to complete a certain project first and get approval or feedback from your client, before you can start the next project.

Letting clients know when a project is coming to an end can be a great way to show that you care deeply about your client. It also avoids any surprises for you and your client down the road. If you need to share an upcoming deadline with a client, try experimenting with this template:

Hi [client name],

Hello! As a friendly reminder, the due date we agreed upon for submitting a rough website draft is coming up on [date].

Please let me know if you need to adjust timeline requirements on your end or if there are any blocking hurdles preventing hitting the deliverable deadline. My goal is to make sure you have all the necessary resources and support needed to comfortably get concepts across the finish line on time without disruption. So I’m very open to feedback on expectations.

But if everything is still on track, please send any working files my way by [deadline date] at your convenience. Just wanted to politely keep this on your radar! Let me know how else I can assist you in the home stretch.

Thanks!

[Your name]

Helpful components in this template include:

- Warm greeting with the client's name

- Upfront statement of deadline details

- Willingness to discuss adjustments

- Offer additional support if needed

- Clear request for files if unchanged

- Closing signature confirming assistance

This template surfaces upcoming expectations while showing your flexibility — reducing last-minute tensions while still keeping accountability.

5. Reminder to sign an updated contract

It’s not uncommon to make a change to a contract when working with a client. I’ve done it multiple times when working with clients through my freelance marketing business. Sometimes, clients will either ask to increase the scope of work or I’ll end up minimizing the scope. In either case, there’s almost always a change in my prices — either going up or down.

In cases where an update needs to be made, here is a template you can gain inspiration from:

Hey [Client name],

I wanted to provide a friendly reminder about the updated contract we recently discussed signing for next month. Please let me know if you have any remaining questions or concerns around the updated terms I can clarify.

Otherwise, whenever you have a spare moment, please do finalize the new contract through the easy e-sign link below at your convenience prior to our upcoming launch:

[eSign contract link]

I truly look forward to continuing our great partnership over the upcoming year!

Best,

[Your name]

Helpful components in this template include:

- Directly addressing client

- Quick context on contract details

- Open door to address concerns

- Clear CTA to sign contract

- Shared excitement for renewal

- Warm closing signature

Overall, this friendly reminder email surfaces a lingering task while keeping a collaborative tone and readiness to answer questions.

6. Reminder to fill out a survey or intake form

Whether you want a client to fill out a survey after they’re done working with you, or you need them to fill in an onboarding intake questionnaire, sometimes it can be hard to keep things flowing when a client forgets to respond to the request.

Thorough client information uncovers the context needed to deliver maximum value. And when initial assessments stall, a friendly check-in gets the ball rolling again. Here is an example of an email reminder you can gain inspiration from:

Hi [name],

Gently following up on the new client intake form and questionnaire I sent over last week to have on file before formally starting work together.

When you have a chance, can you please send back the completed materials in the coming days? And no need to feel locked into any of the responses — we can adjust project specifics down the line. Just want to better understand current priorities as launching points.

Let me know if you need the original questionnaire documents resent or have any other questions!

Thanks,

[Your name]

- Key components of this template include:

- Warm greeting with client's name

- Quick recap of forms needing completion

- Emphasizes flexibility on responses

- Offer to resend forms if needed

- Closing signature showing willingness to assist

7. Reminder of an upcoming appointment

Last but not least, we have appointment reminder emails. Confirming appointment details ahead helps make sure valuable client meetings goes smoothly. When there’s radio silence leading up to scheduled sessions, a gentle confirmation keeps everyone on the same page.

Here’s an example you can gain some inspiration from:

Hi [client name],

Just wanted to confirm the details for our upcoming [consulting/brainstorm/planning] meeting scheduled for next [day] at [time]. Please let me know if you need to adjust anything with timing or format on your end!,

I have us down for [1 hour] via Zoom to focus on [agenda topics like campaign review, milestone planning, etc.] based on our last conversation. But very flexible should any needs change.

Most importantly, I’m looking forward to connecting and further discussing [goals, initiatives] together. Please confirm everything still works on your side whenever you have a chance!

Best,

[Your name]

Some key components of this reminder message include:

- Warm personalized greeting

- Lead with confirmation of scheduled details

- Extend flexibility to adjust if needed

- Recap mutual agenda based on past alignment

- Closing enthusiasm for discussion

The tone remains cooperative and eager to meet without assuming details are locked. A quick yet thoughtful nudge can help you get everyone back in sync!

Send reminders on autopilot

Manually personalizing and sending a steady stream of reminder emails is tough for any busy professional to scale. But letting important check-ins fall through the cracks can negatively impact your client relationships.

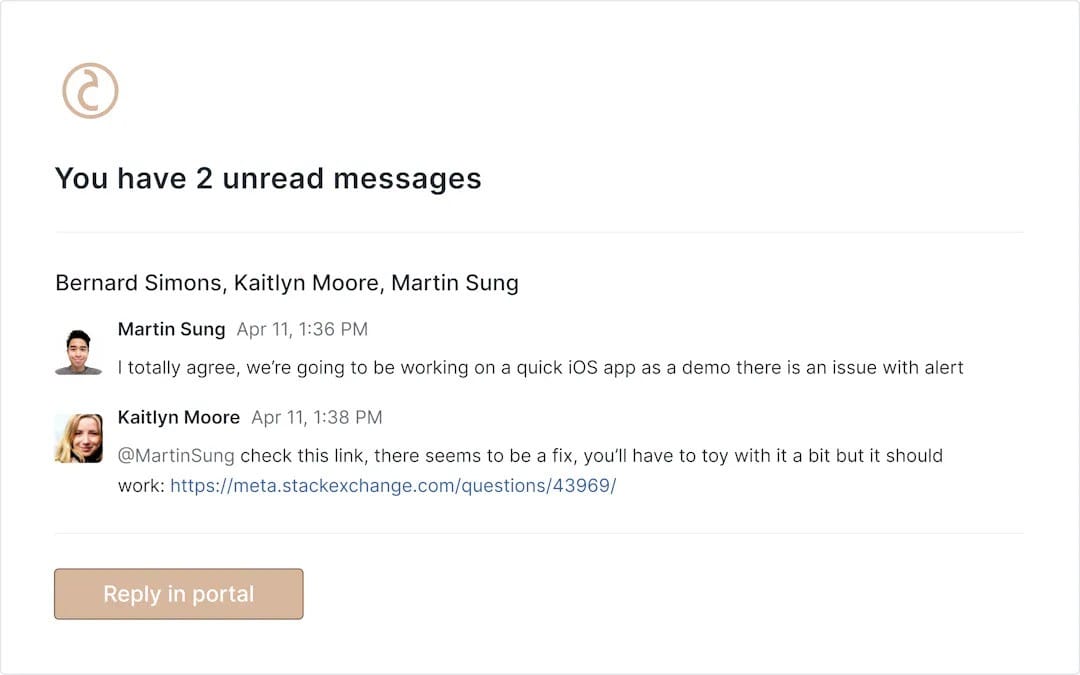

That's why leveraging a specialized tool like Copilot for marketing teams takes the work off your plate. Copilot offers a complete Messaging App that centralizes responsive client communication with capabilities like:

- Saved templates: Create customizable reminder message templates covering common scenarios to reuse. Personalize with merge tags pulling client specifics.

- Mass communication: Bulk broadcast holiday greetings, promotions, and other updates to your entire client base in one click.

- Interlinked email notifications: All messages sent through Copilot auto-sync with clients' email inboxes with portal links for seamless cross-platform connections.

With Copilot's messaging capabilities, you can nurture client relationships at scale while automating consistent, personalized follow-ups that exceed expectations. If you want to explore Copilot’s power for yourself, be sure to play around with the demo client portal!

Share this post

Sign up for our newsletter

Subscribe to our newsletter to receive emails about important announcements, product updates, and guides relevant to your industry.